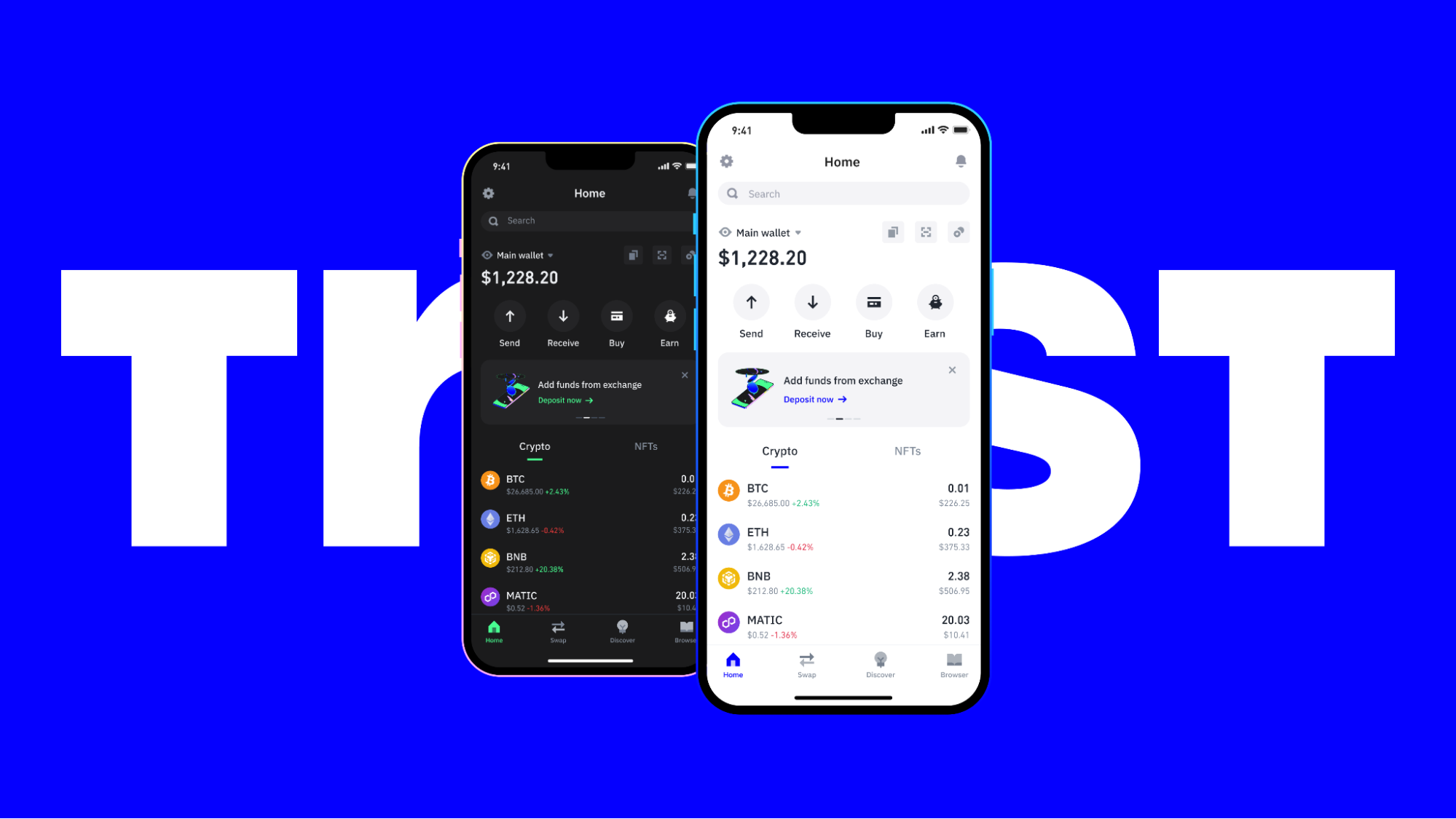

As the world embraces digital currencies, crypto wallets have become an indispensable tool for managing and safeguarding cryptocurrencies. Whether you’re a seasoned investor or a curious newcomer, understanding trustwallet is crucial for navigating the digital finance landscape.

What is a Crypto Wallet?

A crypto wallet is a digital tool that allows users to store, send, and receive cryptocurrencies securely. Unlike traditional wallets, which hold physical cash, crypto wallets store private and public keys—essential for accessing and managing digital assets on the blockchain.

Types of Crypto Wallets

Crypto wallets are broadly classified into two categories:

1. Hot Wallets

Hot wallets are connected to the internet, making them convenient for frequent transactions. Examples include:

- Web Wallets: Accessible through browsers, web wallets are often provided by cryptocurrency exchanges.

- Mobile Wallets: Apps designed for smartphones, offering features like QR code scanning for quick transactions.

- Desktop Wallets: Software installed on computers for secure asset management.

2. Cold Wallets

Cold wallets operate offline, providing enhanced security against hacking attempts. These include:

- Hardware Wallets: Physical devices resembling USB drives, designed to store private keys securely.

- Paper Wallets: Physical documents containing printed private and public keys.

How Do Crypto Wallets Work?

Crypto wallets interact with blockchain networks, enabling users to perform transactions. Here’s a simplified explanation:

- Private and Public Keys: Each wallet generates a pair of cryptographic keys. The private key is used to sign transactions, while the public key acts as an address for receiving funds.

- Blockchain Interaction: When a user initiates a transaction, the wallet broadcasts it to the blockchain network for validation.

- Confirmation: Once miners validate the transaction, it is recorded on the blockchain, and the funds are transferred.

Choosing the Right Wallet

Selecting the right crypto wallet depends on individual needs and preferences. Key factors to consider include:

- Security: For long-term storage, cold wallets are recommended due to their offline nature.

- Accessibility: Hot wallets are ideal for active traders and those requiring frequent access.

- Supported Coins: Ensure the wallet supports the cryptocurrencies you intend to use.

- Ease of Use: User-friendly interfaces are essential, especially for beginners.

Security Best Practices

To safeguard your digital assets, follow these best practices:

- Backup Your Wallet: Keep a secure backup of your wallet’s recovery phrase.

- Enable Two-Factor Authentication (2FA): Add an extra layer of security to your wallet.

- Avoid Sharing Private Keys: Never disclose your private key to anyone.

- Keep Software Updated: Regularly update wallet software to protect against vulnerabilities.

Conclusion

Crypto wallets are the gateway to the exciting world of digital currencies. By understanding their types, functionality, and security measures, users can confidently manage their cryptocurrencies and explore the boundless opportunities of blockchain technology.